QBE Housing Outlook: Australia’s property market recovering, Brisbane set for success

Australia’s property market is expected to take flight again, with growth on the horizon for every major city.

The QBE Australian Housing Outlook suggests property price gains have been spurred on by relaxed lending conditions and the interest rate cuts.

Sydney and Melbourne are set to slowly recover from their dramatic downturns, with a 5 per cent house price rise predicted over the next three years.

But Brisbane is where savvy buyers should be investing to get their money’s worth.

The report predicts a whopping 20.3 per cent rise in house prices to a $548,600 median between now and mid-2022.

Adelaide follows with the second-highest growth, with house prices predicted to rise by 12.7 per cent to a $488,200 median.

QBE Lenders’ Mortgage Insurance CEO Phil White said not enough houses were being built in Brisbane to meet demand, causing the price hike.

“There are a lot more units and very few freestanding houses being built — and that change has been quite noticeable over the last few years,” Mr White said.

“Given the affordability and lifestyle advantages that the market offers, and the increase in tourism that Queensland has benefited from, we would expect to see the Brisbane house market outperform the rest of the country.”

Victoria’s market was being propped up by its population growth and thriving regional centres, Mr White said.

Biggin & Scott director Francesca Nicol said a fast train planned from Melbourne to Ballarat, a town 116km west of Victoria’s capital, would keep price growth in the town strong.

“We’ll literally be a satellite suburb of Melbourne and it will be faster to get here than many other suburbs in the city,” Ms Nicol said. Geelong and Bendigo are other regional towns that will have steady growth.

In Sydney, prices are forecast to rise by 5.8 per cent to a $983,000 median in the next 12 months to June, after a dramatic 12.8 per cent price drop the year before.

Buyer’s agent and Property Buyer director Rich Harvey said it was likely that the worst of the Sydney downturn was over and there would be modest increases in prices over the coming months.

This was partly due more buyers trying to get into the market at a time when listing numbers were down.

“There aren’t many properties getting listed so it’s a really good time to be selling at the moment, but it’s also a good time to buy if you want to get into the market before prices go up more,” Mr Harvey said.

Even larger price rises were on the horizon in the next few years because building activity was beginning to slow, which, coupled with strong population growth, would create a shortage of housing, he said.

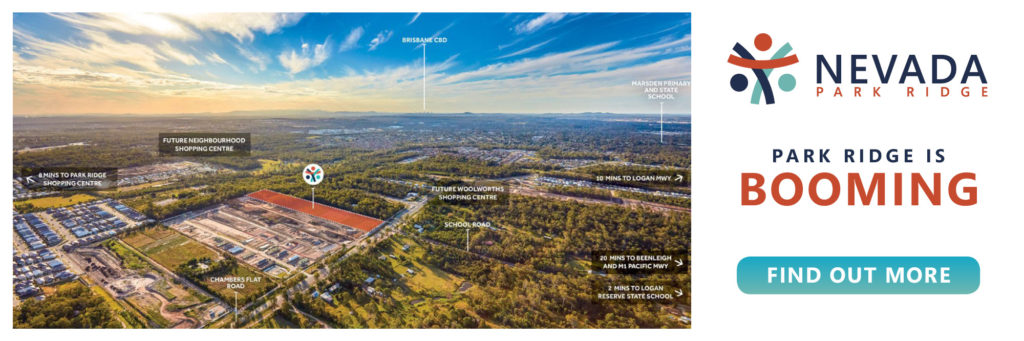

UNCOVER HOME AND LAND PACKAGES AT NEVADA | PARK RIDGE HERE

Similar conditions helped fuel Sydney’s last housing boom and record rises in price over 2014-2017.

Steady price growth is also on the cards for Hobart (4.1 per cent), Canberra (6.4 per cent), Perth (6 per cent) and Darwin (7 per cent) in the next three years. Source: realestate.com.au